The Single-Family Rentals in Build-to-Rent Communities report by Yardi Matrix shares an update of the SFR market in 2024. Overall, single-family rentals are continuing to grow in built-to-rent communities. Both rent and occupancy growth have been strong in recent months while remaining a financially viable option for renters.

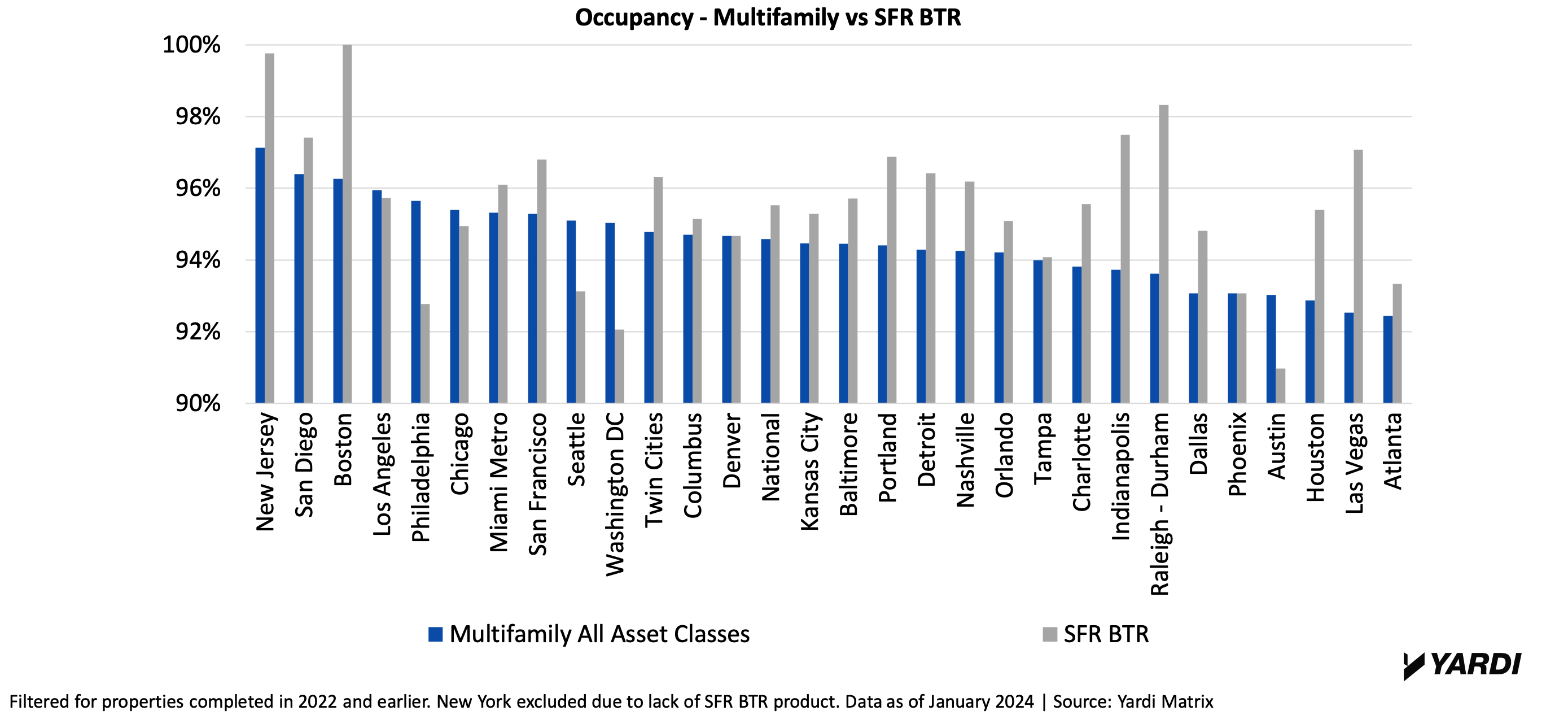

Over two-thirds of the top 30 metros have higher occupancy rates from single-family rentals in BTR communities than other multifamily assets.

4 Biggest Demand Drivers for Single-Family Rentals

But aside from price, what’s driving the demand? Four of the biggest demand drivers for single-family rentals are work-from-home professionals, household growth, the declining affordability of homeownership, and the demographics of Millennials and blue-collar workers.

1. Renters working from home

Because more than half (52%) of full-time workers are now returning back to the office, hybrid work is becoming the norm. Single-family rentals are more accommodating to this shifting demographic than traditional apartments; SFR offers a quieter environment and more space inside the home for the hybrid worker.

2. Household formation growth during the pandemic

Demand is also driven by household formation growth during the pandemic as a result of:

- Employment/wage growth.

- Stimulus payments.

- Increased savings.

3. Declining homebuying affordability

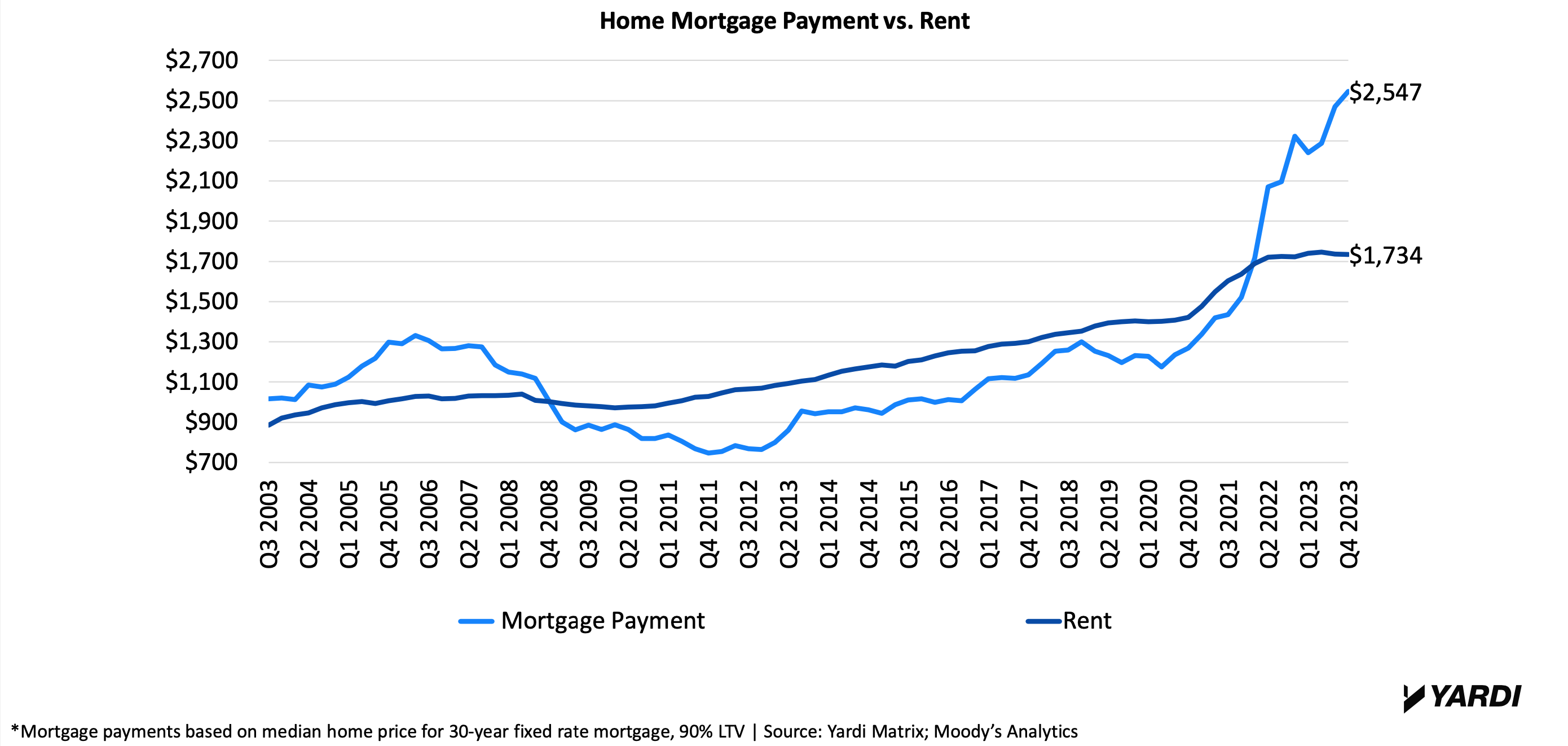

According to the Yardi Matrix report, 61% of renters in the largest metros are priced out of homebuying. The average home mortgage payment reached $2,547 at the end of 2023. Compare this to the average rent of $1,734 and renting looks like the better deal.

As the affordability of buying a home decreases, single-family rentals are prime for Millennials and blue-collar workers who would like to buy a house, but can’t.

4. Specific demographics

Those averaging a salary of $60,000 to $70,000 a year, individuals aged 24 to 40, and Millennials/blue-collar workers are largely driving the demand for single-family rentals in built-to-rent communities.

SFR development trends indicate that flexible designs and lot size by location are based on consumer preferences. For example, young singles and couples prefer pet-friendly units, while young families prefer large common areas.

RELATED: Multifamily rent remains flat at $1,710 in January

Development Trends

The four biggest single-family rental development trends as of 2024 include:

- Amenities. On-site maintenance and community areas are the most popular. Better parking, storage, privacy, and yard space is also highly desired.

- Smart home technology. This has become a “must” and will likely be standard soon, according to Yardi. Developers should plan for future demand such as electric vehicle charging in garages.

- Homes designed for frequent moving. Single-family rentals are using resilient materials like laminate faux wood flooring to maintain a durable, sleek look. Units are designed with wider hallways to accommodate the moving of furniture in and out of the home.

- Flexibility. Target demographics and location influence the design of build-to-rent communities. While younger renters would prefer pet-friendly units and large common areas, older singles and couples prefer an attached garage.

Click here to view the full Yardi Matrix Single-Family Rentals in Build-to-Rent Communities report.

Related Stories

Senior Living Design | Apr 24, 2024

Nation's largest Passive House senior living facility completed in Portland, Ore.

Construction of Parkview, a high-rise expansion of a Continuing Care Retirement Community (CCRC) in Portland, Ore., completed recently. The senior living facility is touted as the largest Passive House structure on the West Coast, and the largest Passive House senior living building in the country.

ProConnect Events | Apr 23, 2024

5 more ProConnect events scheduled for 2024, including all-new 'AEC Giants'

SGC Horizon present 7 ProConnect events in 2024.

Mixed-Use | Apr 23, 2024

A sports entertainment district is approved for downtown Orlando

This $500 million mixed-use development will take up nearly nine blocks.

Resiliency | Apr 22, 2024

Controversy erupts in Florida over how homes are being rebuilt after Hurricane Ian

The Federal Emergency Management Agency recently sent a letter to officials in Lee County, Florida alleging that hundreds of homes were rebuilt in violation of the agency’s rules following Hurricane Ian. The letter provoked a sharp backlash as homeowners struggle to rebuild following the devastating 2022 storm that destroyed a large swath of the county.

Student Housing | Apr 19, 2024

$115 million Cal State Long Beach student housing project will add 424 beds

A new $115 million project recently broke ground at California State University, Long Beach (CSULB) that will add housing for 424 students at below-market rates. The 108,000 sf La Playa Residence Hall, funded by the State of California’s Higher Education Student Housing Grant Program, will consist of three five-story structures connected by bridges.

Sponsored | Multifamily Housing | Apr 19, 2024

5 Reasons to Opt for Wood I-Joists in Multifamily Construction

From versatility to reliability and adaptability, engineered wood I-joists offer builders, designers and developers numerous advantages in multifamily construction. Discover the top five benefits and handy installation tips.

MFPRO+ News | Apr 18, 2024

Marquette Companies forms alliance with Orion Residential Advisors

Marquette Companies, a national leader in multifamily development, investment, and management, announces its strategic alliance with Deerfield, Ill.-based Orion Residential Advisors, an integrated multifamily investment and operating firm active in multiple markets nationwide.

MFPRO+ New Projects | Apr 16, 2024

Marvel-designed Gowanus Green will offer 955 affordable rental units in Brooklyn

The community consists of approximately 955 units of 100% affordable housing, 28,000 sf of neighborhood service retail and community space, a site for a new public school, and a new 1.5-acre public park.

MFPRO+ News | Apr 15, 2024

Two multifamily management firms merge together

MEB Management Services, a Phoenix-based multifamily management company, and Weller Management, a third-party property management and consulting company, officially merged to become Bryten Real Estate Partners—creating a nationally recognized management company.

Mixed-Use | Apr 13, 2024

Former industrial marina gets adaptive reuse treatment

At its core, adaptive reuse is an active reimagining of the built environment in ways that serve the communities who use it. Successful adaptive reuse uncovers the latent potential in a place and uses it to meet people’s present needs.