From 2021 to 2023, the construction industry faced a tumultuous economic climate, marked by a confluence of challenging trends that have tested the resilience of industry executives. This period saw a significant surge in the demand for construction labor, primarily driven by an uptick in infrastructure project spending.

This rise in demand coincided with an increase in inflation, which exerted additional upward pressure on construction wages, culminating in a notable 20% nominal wage increase over the two years, as per a comprehensive January 2024 report by Gordian and ConstructConnect. Unfortunately, a major change in construction labor dynamics at the federal level is likely to compound this rising cost structure in 2024 and beyond.

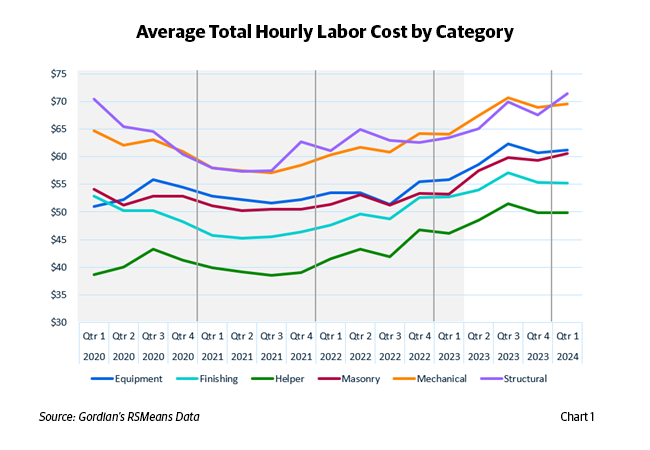

The tightening labor market within the construction sector has reached unprecedented levels. Demand for skilled workers has outpaced supply, creating a competitive environment where wages have soared to attract the necessary workforce. This dynamic has been further complicated by the highest sustained inflation in the U.S. economy since 1981, as indicated by the Consumer Price Index (CPI-U). The Infrastructure Investment and Jobs Act (IIJA) further amplified labor demand with its significant financial injection into public works and infrastructure projects. Construction wages increased to match both the surge in demand and general inflation, rising an average of 20% from 2021 to 2023. See Chart 1 for a detailed breakdown by category.

Chart 1: Average Wage Growth by Trade, 2021 to 2023

Federal Mandates Include the New Prevailing Wage Calculation

Looking ahead to 2024 and beyond, two pivotal changes in federal construction labor dynamics are likely to exacerbate the increasing cost structure. The first is the mandate of Project Labor Agreements (PLAs) for all federally funded projects exceeding $35 million in contract value, as decreed by an Executive Order in February 2022. PLAs are known to potentially inflate project labor costs by 12%-20%. Considering that approximately 40% of the $34 billion federal construction budget may be affected by PLAs, contractors are bracing for a widespread impact on labor costs.

The second significant change involves the Department of Labor's overhaul of the Davis-Bacon Act in 2023. This revision reinstated the "3-step process" for calculating prevailing wages, which had previously been a "2-step process" for over 40 years. Since 1983, prevailing wage has been calculated using only two steps:

- The wage rate paid to a majority of workers in the classification, or

- If no rate is paid to at least 50% of workers, then the weighted average rate in the classification.

By reinstating the 3-step process, the prevailing wage is calculated as follows:

- The wage rate paid to a majority of workers in the classification, or

- If no majority exists, the rate paid to 30% of workers, or

- If no rate paid to at least 30% of that classification’s workers, then the weighted average in the classification.

The overhaul also changed the mechanisms by which urban and rural wages are differentiated and updated between survey releases. With an estimated 1.2 million workers in the construction industry affected by these changes, the new calculation method is expected to elevate wages, particularly in regions with moderate-to-weak union presence, where collective bargaining agreements will now have greater influence in establishing prevailing wages. This change, coupled with more frequent updates to rural prevailing wage estimates, suggests that rural laborers' wages are also set to rise at a quicker pace than before.

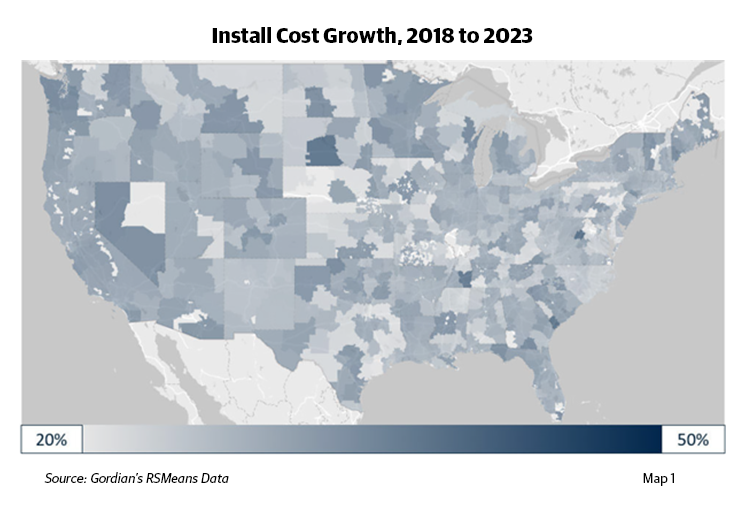

These legislative and economic adjustments have also led to emerging regional disparities in labor costs across the United States. Traditionally low-cost areas are witnessing a sharper incline in construction trade wages, a trend that has started to manifest itself with increasing clarity. See Map 1 below.

MAP 1: Install Cost Growth, 2018 to 2023

The situation presents a complex challenge for businesses within the construction industry. They are now tasked with managing the delicate balance of compensating their workforce adequately while grappling with reduced productivity per labor hour. The increased costs are not only felt in wages but also in the broader economic impact, including the prices of materials and the overall cost of construction projects.

Mitigating the Impact of Federal Mandates

As companies strategize to navigate this new landscape, they are exploring various approaches to mitigate the impact of these changes. Some are investing in technology and automation to improve efficiency and reduce their reliance on an increasingly expensive labor force. Others are reevaluating their project management strategies, seeking ways to streamline operations and optimize the use of available labor.

Moreover, the industry is placing a greater emphasis on training and development, aiming to upskill the existing workforce to meet the evolving demands of modern construction projects. By enhancing the skill set of their workers, companies hope to increase productivity and offset some of the rising labor costs.

In addition to internal strategies, there is also a push for policy advocacy. Industry leaders are engaging with policymakers to discuss the implications of the recent changes and to explore potential measures that could ease the burden on the construction sector. These discussions are crucial in shaping a regulatory environment that supports the sustainable growth of the industry while ensuring fair compensation for its workforce.

As the construction industry continues to adapt to these economic pressures, the importance of strategic planning and proactive management has never been more critical. Companies that successfully navigate this "perfect storm" will be those that are agile, innovative and forward-thinking in their approach to labor management and cost control. With the right strategies in place, the industry can continue to thrive despite the challenges, building a robust future for both its businesses and its workforce.

About the Author

Samuel Giffin (s.giffin@gordian.com), Director of Data Operations at Gordian, is responsible for leading and developing engineering, research and professional services teams in providing data to power Gordian's construction estimating and procurement solutions.

Related Stories

Construction Costs | Apr 18, 2024

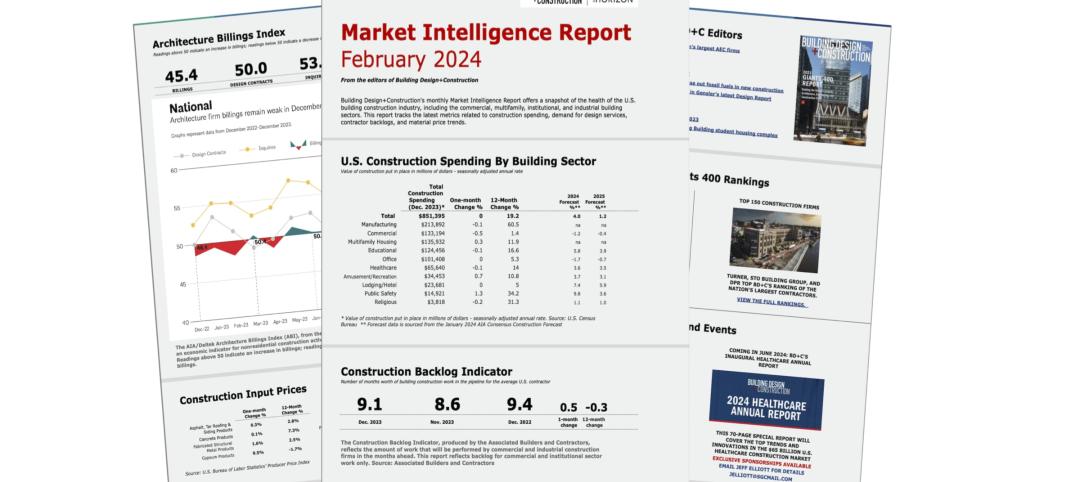

New download: BD+C's April 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Construction Costs | Apr 11, 2024

Construction materials prices increase 0.4% in March 2024

Construction input prices increased 0.4% in March compared to the previous month, according to an Associated Builders and Contractors analysis of the U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices also increased 0.4% for the month.

Construction Costs | Mar 15, 2024

Retail center construction costs for 2024

Data from Gordian shows the most recent costs per square foot for restaurants, social clubs, one-story department stores, retail stores and movie theaters in select cities.

Market Data | Mar 14, 2024

Download BD+C's March 2024 Market Intelligence Report

U.S. construction spending on buildings-related work rose 1.4% in January, but project teams continue to face headwinds related to inflation, interest rates, and supply chain issues, according to Building Design+Construction's March 2024 Market Intelligence Report (free PDF download).

Construction Costs | Feb 27, 2024

Experts see construction material prices stabilizing in 2024

Gordian’s Q1 2024 Quarterly Construction Cost Insights Report brings good news: Although there are some materials whose prices have continued to show volatility, costs at a macro level are returning to a level of stability, suggesting predictable historical price escalation factors.

Construction Costs | Feb 22, 2024

K-12 school construction costs for 2024

Data from Gordian breaks down the average cost per square foot for four different types of K-12 school buildings (elementary schools, junior high schools, high schools, and vocational schools) across 10 U.S. cities.

Market Data | Feb 7, 2024

New download: BD+C's February 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Construction Costs | Jan 22, 2024

Construction material prices continue to normalize despite ongoing challenges

Gordian’s most recent Quarterly Construction Cost Insights Report for Q4 2023 describes an industry still attempting to recover from the impact of COVID. This was complicated by inflation, weather, and geopolitical factors that resulted in widespread pricing adjustments throughout the construction materials industries.

Construction Costs | Nov 15, 2023

Construction input prices decrease 1.2% in October, driven by lower energy, lumber, and steel prices

Construction input prices declined 1.2% in October on a monthly basis, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices fell 1.1% for the month.

Contractors | Nov 1, 2023

Nonresidential construction spending increases for the 16th straight month, in September 2023

National nonresidential construction spending increased 0.3% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.1 trillion.