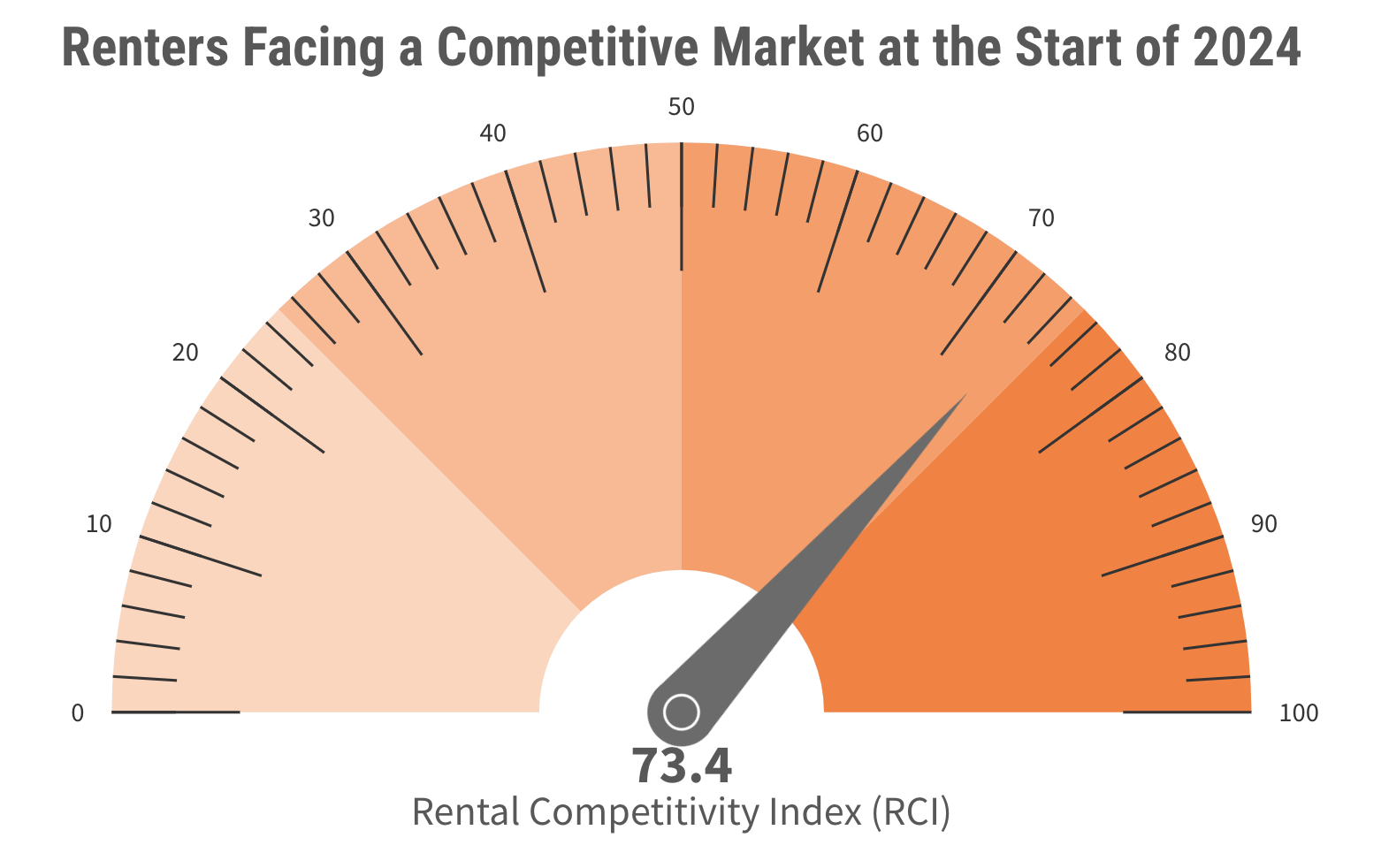

The U.S. rental market in early 2024 is moderately competitive, with apartments taking an average of 41 days to find tenants, according to the latest RentCafe Market Competitivity Report. The report looked through 139 of the nation’s largest markets to find where the hottest renting spots are located.

RentCafe used five relevant metrics in terms of rental competitiveness to determine an overall score. The metrics were averaged using October through December 2023 data:

- Number of days apartments were vacant

- Percentage of apartments that were occupied by renters

- Number of prospective renters competing for an apartment

- Percentage of renters who renewed their leases

- Share of new apartments completed recently

RentCafe analyzed the metrics on a national level to determine a Rental Competitiveness Index (RCI). At the start of 2024, the national RCI score was 73.4, indicating a moderately competitive rental market.

Compared to 2023, slightly more renters renewed their leases (61.5%) than the previous year (60.7%). The number of already occupied apartments went down (93%—down from 94.2% in 2023) but this is likely because there was a greater amount of apartments being built. By 2024, 0.67% of available rental units were built, as opposed to 0.43% in 2023.

Top 20 Most Competitive Rental Markets at the Start of 2024

At the regional level, markets with a thriving economy are more attractive than others. With a competitive score of 92, Miami, Fla., continues to be the most competitive rental market in the U.S. at the start of the year.

Where do other markets fare? Here are 20 of the most competitive and sought-after rental markets in 2024:

1. Miami-Dade, Fla.

The Miami-Dade market has a competitive score of just under 92, topping the list. A staggering 96.5% of the area’s apartments are occupied and have a 73% renewal rate.

Each apartment sees competition from an average of 14 prospective tenants. The average timeframe for units being vacant is 36 days.

2. Milwaukee, Wis.

Milwaukee has a competitive score of 87. Over 95% of the area’s apartments are occupied and have a 72% renewal rate.

Each apartment sees competition from an average of nine prospective residents. The average time a unit stays on the market before becoming occupied is 37 days.

3. North Jersey, N.J.

The North Jersey area meets an overall competitive score of 85 points. Nearly 96% of its apartments are occupied, with an average lease renewal rate of 73%.

There are an average of nine prospective renters for each apartment. Units are vacant for around 38 days before finding a tenant.

4. Suburban Chicago, Ill.

The Suburban Chicago market has a competitive score of 85. With 95% of the area’s apartments already occupied, the area’s renewal rate averages out to 68%.

Each apartment sees competition from an average of 10 prospective tenants. The average timeframe for units being vacant is 37 days.

5. Grand Rapids, Mich.

Grand Rapids has a competitive score of 85. Over 95% of the area’s apartments are occupied and have a 77% renewal rate—the highest lease renewal rate of the list.

Each apartment sees competition from an average of six prospective residents. The average time a unit stays on the market before becoming occupied is 39 days.

6. Oklahoma City, Okla.

Oklahoma City meets an overall competitive score of 83 points. Over 93% of its apartments are occupied, with an average lease renewal rate of 63%.

There are an average of six prospective renters for each apartment. Units are vacant for around 35 days—one of the lowest among the list—before finding a tenant.

7. Bridgeport-New Haven, Conn.

The Bridgeport-New Haven market has a competitive score of 83. Over 95% of the area’s apartments are occupied and have a 63% renewal rate.

Each apartment sees competition from an average of nine prospective tenants. The average timeframe for units being vacant is 39 days.

8. Cincinnati, Ohio

Cincinnati has a competitive score of 82. Nearly 95% of the area’s apartments are occupied and have a 66% renewal rate.

Each apartment sees competition from an average of nine prospective residents. The average time a unit stays on the market before becoming occupied is 38 days.

9. Lansing-Ann Arbor, Mich.

The Lansing-Ann Arbor area meets an overall competitive score of 82 points. Over 94% of its apartments are occupied, with an average lease renewal rate of 69%.

There are an average of 6 prospective renters for each apartment. Like Cincinnati, units are vacant for 38 days before finding a tenant.

10. Orlando, Fla.

Orlando has a competitive score of 81. With 94% of the area’s apartments already occupied, the area’s renewal rate averages out to 69%.

Each apartment sees competition from an average of eight prospective tenants. The average timeframe for units being vacant is 39 days.

11. Orange County, Calif.

Orange County has a competitive score of 81. Over 96% of the area’s apartments are occupied with a 60% renewal rate.

Each apartment sees competition from an average of 11 prospective residents—the second-most amount behind Miami. The average time a unit stays on the market before becoming occupied is 40 days.

12. Brooklyn, N.Y.

Brooklyn meets an overall competitive score of 81 points. Over 96% of its apartments are occupied, with an average lease renewal rate of 69%.

There are an average of five prospective renters for each apartment—the lowest of all the markets. Units are vacant for around 39 days before finding a tenant.

13. Omaha, Neb.

The Omaha market has a competitive score of just under 80. With 95% of the area’s apartments already occupied, lease renewal rates average out to 66%.

Each apartment sees competition from an average of eight prospective tenants. The average timeframe for units being vacant is 35 days.

14. Southwest Florida

Southwest Florida has a competitive score of 79. Over 94% of the area’s apartments are occupied, leaving the area’s lease renewal rate at 70%.

Each apartment sees competition from an average of seven prospective tenants. The average timeframe for units being vacant is 38 days.

15. Eastern Virginia

The Eastern Virginia region has a competitive score of 79. Nearly 94% of the area’s apartments are occupied with a 63% renewal rate.

Each apartment sees competition from an average of eight prospective residents. The average time a unit stays on the market before becoming occupied is 40 days.

16. Kansas City, Kan.

Kansas City has a competitive score of 79. Over 93% of the area’s apartments are occupied and have a 68% renewal rate.

Each apartment sees competition from an average of six prospective residents. The average time a unit stays on the market before becoming occupied is 39 days.

17. Tampa, Fla.

Tampa meets an overall competitive score of 78 points. Nearly 94% of its apartments are occupied, with an average lease renewal rate of 65%.

There are an average of eight prospective renters for each apartment. Units are vacant for around 40 days before finding a tenant.

18. San Diego, Calif.

The San Diego market also has a competitive score of 78. With nearly 95% of the area’s apartments already occupied, the area’s renewal rate averages out to just under 50%—the second lowest of the list.

Each apartment sees competition from an average of nine prospective tenants. The average timeframe for units being vacant is 38 days.

19. Suburban Philadelphia, Pa.

Suburban Philadelphia has a competitive score of 78. Over 94% of the area’s apartments are occupied and have a 75% renewal rate.

Each apartment sees competition from an average of seven prospective residents. The average time a unit stays on the market before becoming occupied is 45 days—the longest time frame of the list.

20. Silicon Valley, Calif.

Silicon Valley meets an overall competitive score of exactly 78 points. Over 94% of its apartments are occupied, with the lowest lease renewal rate of 47%.

There are an average of nine prospective renters for each apartment. Units are vacant for around 37 days before finding a tenant.

Related Stories

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.

Industry Research | Apr 4, 2024

Expenses per multifamily unit reach $8,950 nationally

Overall expenses per multifamily unit rose to $8,950, a 7.1% increase year-over-year (YOY) as of January 2024, according to an examination of more than 20,000 properties analyzed by Yardi Matrix.

Student Housing | Mar 27, 2024

March student housing preleasing in line with last year

Preleasing is still increasing at a historically fast pace, surpassing 61% in February 2024 and marking a 4.5% increase year-over-year.

Adaptive Reuse | Mar 26, 2024

Adaptive Reuse Scorecard released to help developers assess project viability

Lamar Johnson Collaborative announced the debut of the firm’s Adaptive Reuse Scorecard, a proprietary methodology to quickly analyze the viability of converting buildings to other uses.

MFPRO+ News | Mar 16, 2024

Multifamily rents stable heading into spring 2024

National asking multifamily rents posted their first increase in over seven months in February. The average U.S. asking rent rose $1 to $1,713 in February 2024, up 0.6% year-over-year.

MFPRO+ News | Mar 12, 2024

Multifamily housing starts and permitting activity drop 10% year-over-year

The past year saw over 1.4 million new homes added to the national housing inventory. Despite the 4% growth in units, both the number of new homes under construction and the number of permits dropped year-over-year.

MFPRO+ Research | Mar 6, 2024

Top 10 trends in senior living facilities for 2024

The 65-and-over population is growing faster than any other age group. Architects, engineers, and contractors are coming up with creative senior housing solutions to better serve this burgeoning cohort.

Multifamily Housing | Mar 4, 2024

Single-family rentals continue to grow in BTR communities

Single-family rentals are continuing to grow in built-to-rent communities. Both rent and occupancy growth have been strong in recent months while remaining a financially viable option for renters.

MFPRO+ News | Mar 1, 2024

Housing affordability, speed of construction are top of mind for multifamily architecture and construction firms

The 2023 Multifamily Giants get creative to solve the affordability crisis, while helping their developer clients build faster and more economically.

MFPRO+ Research | Feb 28, 2024

New download: BD+C's 2023 Multifamily Amenities report

New research from Building Design+Construction and Multifamily Pro+ highlights the 127 top amenities that developers, property owners, architects, contractors, and builders are providing in today’s apartment, condominium, student housing, and senior living communities.