Construction employment in May remained below the April level in 40 states and the District of Columbia, according to an analysis by the Associated General Contractors of America of government employment data released today. Association officials said skyrocketing materials prices and excessive delays in receiving key construction supplies were holding back the industry’s recovery.

“Today’s numbers show that impacts from the pandemic on demand for projects and on materials costs and the supply chain are weighing down construction in most parts of the country,” said Ken Simonson, the association’s chief economist. “In the few states where industry employment has topped the pre-pandemic levels of February 2020, most gains are likely attributable more to demand for homebuilding and remodeling than to most categories of nonresidential building and infrastructure projects.”

From April to May, construction employment decreased in 40 states and D.C., increased in only eight states, and held steady in Maryland and Utah. The largest decline over the month occurred in New York, which lost 5,900 construction jobs or 1.6%, followed by Illinois (-5,600 jobs, -2.5%) and Pennsylvania (-3,300 jobs, -1.3%). The steepest percentage declines since April occurred in Vermont (-3.9%, -600 jobs), followed by Maine (-3.5%, -1,100 jobs) and Delaware (-3.0%, -300 jobs).

Florida added the most construction jobs between April and May (3,700 jobs, 0.6%), followed by Michigan (1,600 jobs, 0.9%) and Minnesota (1,200 jobs, 0.9%). Oklahoma had the largest percentage gain for the month (1.3%, 1,000 jobs), followed by Minnesota and Michigan.

Employment declined from the pre-pandemic peak month of February 2020 in 42 states and D.C. Texas lost the most construction jobs over the period (-49,100 jobs or -6.3%), followed by New York (-45,200 jobs, -11.1%) and California (-30,800 jobs, -3.4%). Wyoming recorded the largest percentage loss (-15.3%, -3,500 jobs), followed by Louisiana (-15.1%, -20,700 jobs) and New York.

Among the eight states that added construction jobs since February 2020, the largest pickup occurred in Utah (5,000 jobs, 4.4%), followed by Idaho (3,400 jobs, 6.2%) and South Dakota (1,200 jobs, 5.0%). The largest percentage gain was in Idaho, followed by South Dakota and Utah.

Association officials noted that cost increases and extended lead times for producing many construction materials are exacerbating a slow recovery for construction. They urged the Biden administration to accelerate its timetable for reaching agreement with allies on removing tariffs on steel and aluminum, and to initiate talks to end tariffs on Canadian lumber.

“Federal officials can help get more construction workers employed by removing tariffs on essential construction materials such as lumber, steel and aluminum,” said Stephen E. Sandherr, the association’s chief executive officer. “These tariffs are causing unnecessary harm to construction workers and firms, as well as to the administration’s goals of building more affordable housing and infrastructure.”

View state February 2020-May 2021 data, 15-month rankings, 1-month rankings.

Related Stories

Hotel Facilities | Apr 24, 2024

The U.S. hotel construction market sees record highs in the first quarter of 2024

As seen in the Q1 2024 U.S. Hotel Construction Pipeline Trend Report from Lodging Econometrics (LE), at the end of the first quarter, there are 6,065 projects with 702,990 rooms in the pipeline. This new all-time high represents a 9% year-over-year (YOY) increase in projects and a 7% YOY increase in rooms compared to last year.

Construction Costs | Apr 18, 2024

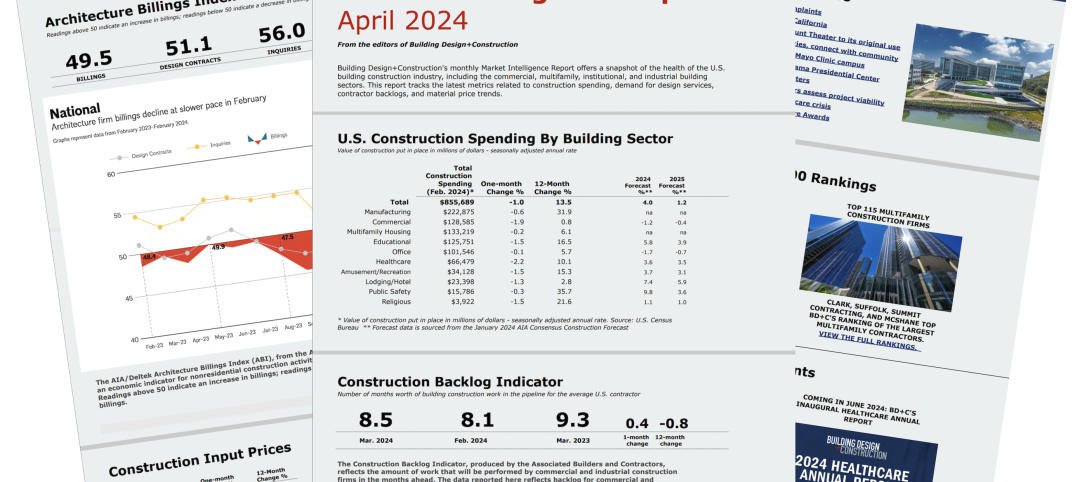

New download: BD+C's April 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Market Data | Apr 16, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of March 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.2 months in March from 8.1 months in February, according to an ABC member survey conducted March 20 to April 3. The reading is down 0.5 months from March 2023.

K-12 Schools | Apr 10, 2024

Surprise, surprise: Students excel in modernized K-12 school buildings

Too many of the nation’s school districts are having to make it work with less-than-ideal educational facilities. But at what cost to student performance and staff satisfaction?

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.

Retail Centers | Apr 4, 2024

Retail design trends: Consumers are looking for wellness in where they shop

Consumers are making lifestyle choices with wellness in mind, which ignites in them a feeling of purpose and a sense of motivation. That’s the conclusion that the architecture and design firm MG2 draws from a survey of 1,182 U.S. adult consumers the firm conducted last December about retail design and what consumers want in healthier shopping experiences.

Market Data | Apr 1, 2024

Nonresidential construction spending dips 1.0% in February, reaches $1.179 trillion

National nonresidential construction spending declined 1.0% in February, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.179 trillion.

Market Data | Mar 26, 2024

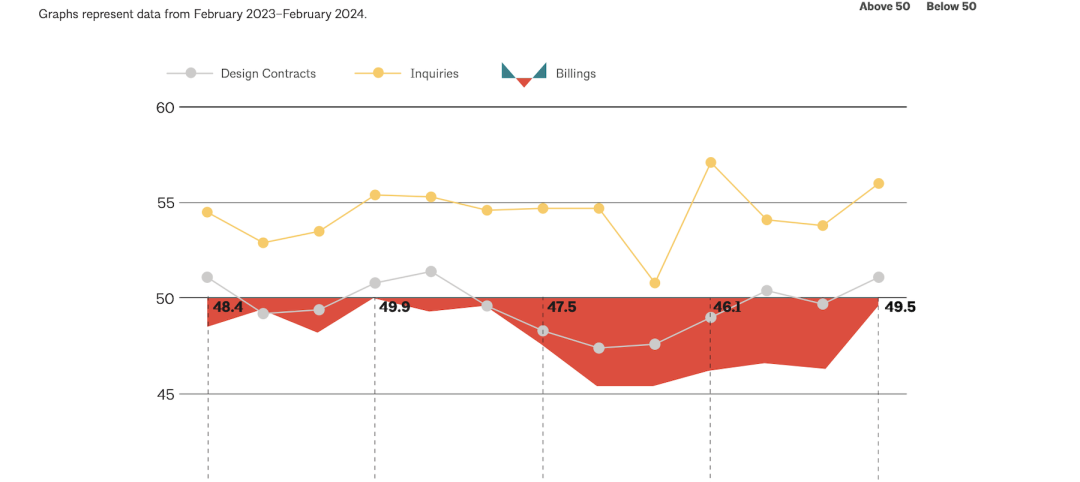

Architecture firm billings see modest easing in February

Architecture firm billings continued to decline in February, with an AIA/Deltek Architecture Billings Index (ABI) score of 49.5 for the month. However, February’s score marks the most modest easing in billings since July 2023 and suggests that the recent slowdown may be receding.

K-12 Schools | Mar 18, 2024

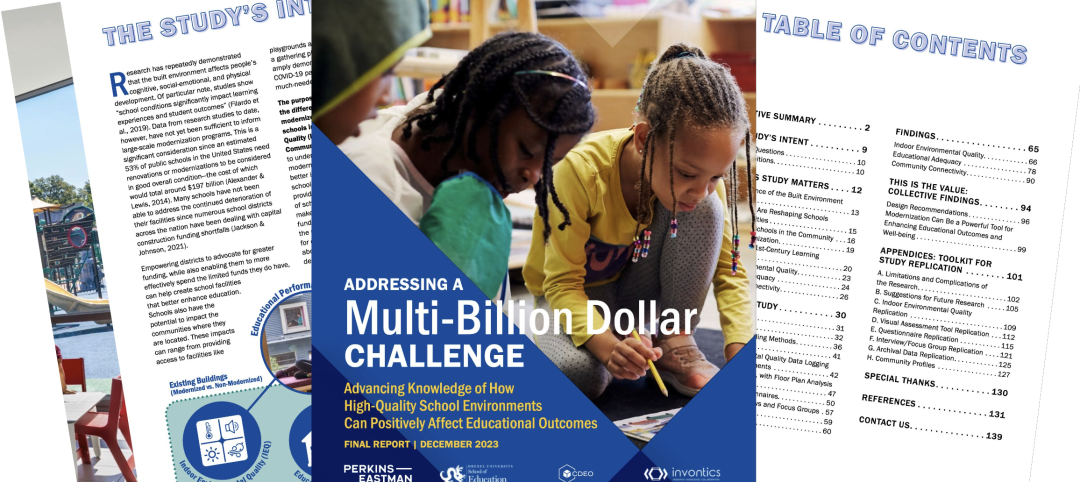

New study shows connections between K-12 school modernizations, improved test scores, graduation rates

Conducted by Drexel University in conjunction with Perkins Eastman, the research study reveals K-12 school modernizations significantly impact key educational indicators, including test scores, graduation rates, and enrollment over time.

MFPRO+ News | Mar 16, 2024

Multifamily rents stable heading into spring 2024

National asking multifamily rents posted their first increase in over seven months in February. The average U.S. asking rent rose $1 to $1,713 in February 2024, up 0.6% year-over-year.