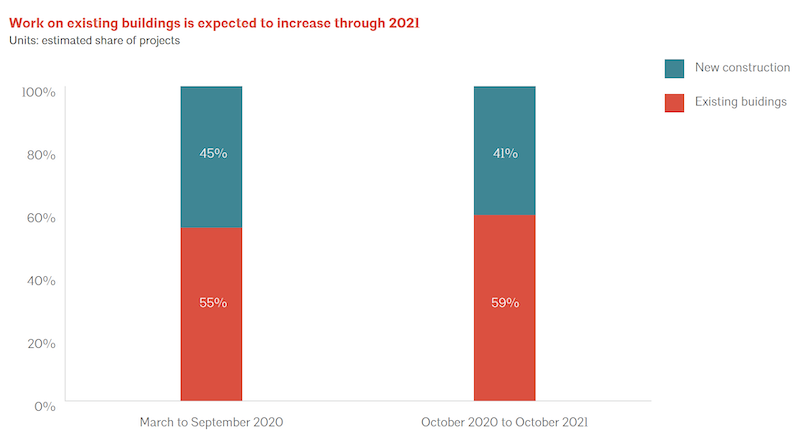

The coronavirus pandemic accelerated a shift toward architectural design work on existing buildings that already had been underway. That shift presents new opportunities, but also challenges that manufacturers and other partners can help architects meet. But when it comes to designing sustainably, architects need to become more than just “passive advisors” who leave final decisions to clients.

These are some of the key findings from a new 43-page report, “Business Opportunities & Sustainability Trends Amidst a Pandemic,” that has been published by the American Institute of Architects (AIA) in partnership with Oldcastle Building Technology. The report is based on responses from 229 architecture firms that completed a survey that was in the field from October 20 through November 17, 2020.

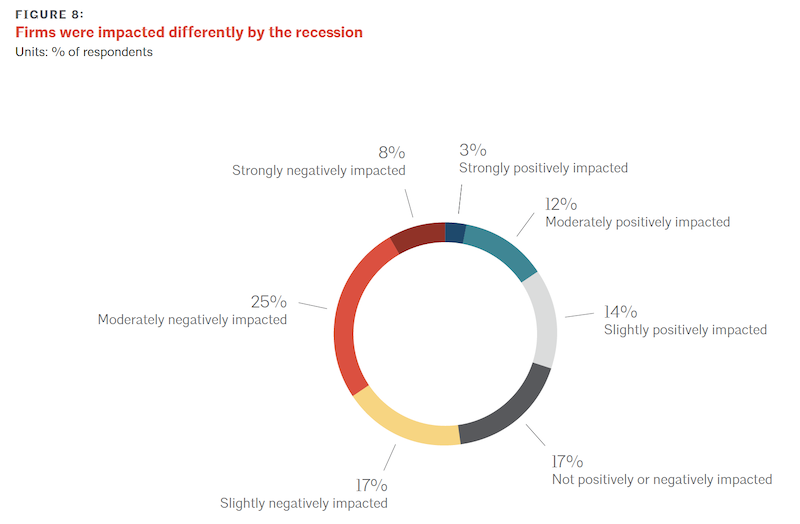

The largest number of respondents was affected by the recession only moderately.

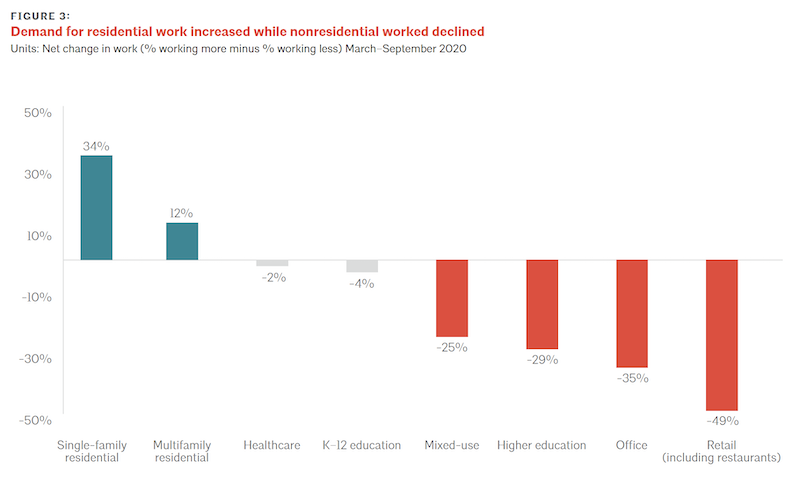

The study found 2020 to be “a tale of two markets,” with declining demand in most nonresidential sectors and increasing demand in residential sectors, especially single family. From March to September 2020, surveyed respondents reported an increase of 34% for single-family work and 12% for multifamily; and a net decrease in work in the nonresidential sectors including retail (down 49%), offices (-35%) and Higher Ed (-29%).

Demand for residential design was the one silver lining of last year's COVID-19 outbreak. And the nonres sectors that took it on the chin are likely to see most of their new work in existing buildings in 2021.

According to the AIA Consensus Construction Forecast released in January 2021, nonresidential building spending is expected to continue to decrease with a forecasted decline of 5.7% in 2021. Out of nonresidential building spending, the commercial sector is expected to continue to decline the most in 2021, by 7.1%, compared with 4% for the institutional sector.

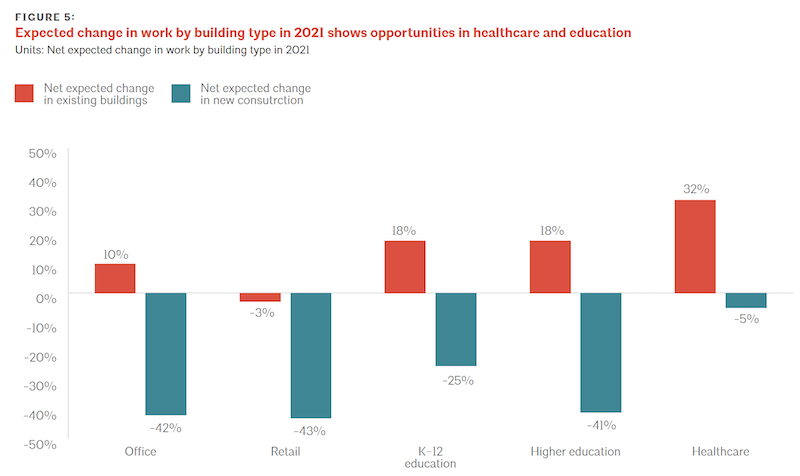

Healthcare, higher education, and K–12 education are expected to have the greatest opportunities for growth in existing buildings in 2021, whereas there are declines expected in new building projects.

EXTERNAL COMMUNICATION WAS TOUGH DURING PANDEMIC

The pandemic's impact on client relationships was relatively minor. But budgeting was cited as the biggest challenge for architects working on existing buildings.

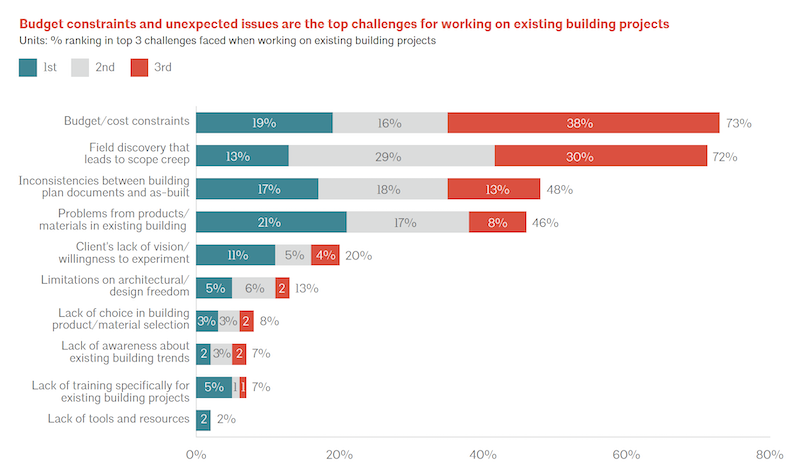

The two biggest challenges architectural professionals reported facing with existing buildings were budget/cost constraints (73% of responses) and field discovery that leads to scope creep (72%). Further, nearly half (48%) of those surveyed reported the challenges of inconsistencies between building plan documents and as-built, and problems from products/materials in existing buildings (46%).

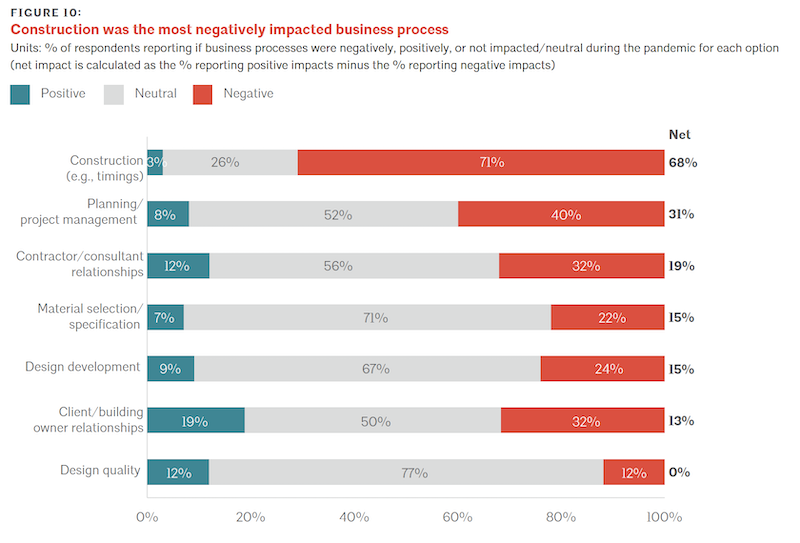

Many firms shifted into a virtual work environment during the pandemic, and found it difficult to maintain productivity. Of the 71% of architects who reported negative impacts on construction, some of the reasons given were delayed timelines, price increases for materials or limited materials, lack of workers, COVID-19 restrictions, and difficulties with external communications.

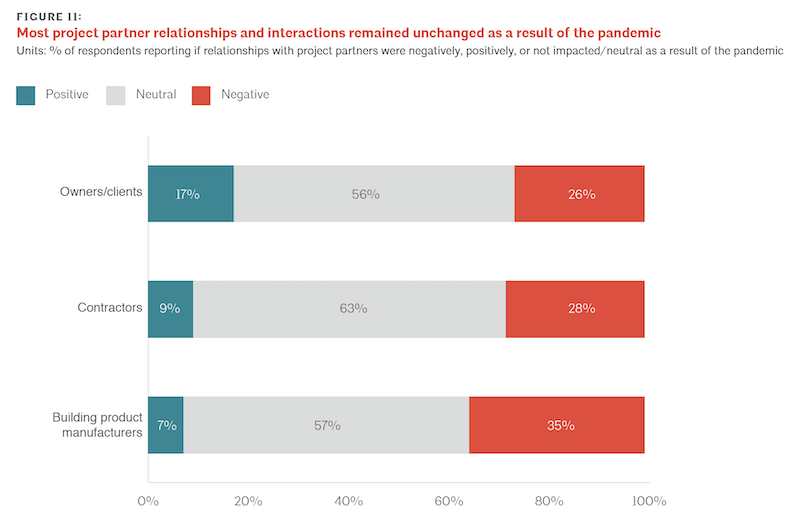

A little over one quarter (26%) reported the pandemic negatively impacted their relationships with clients. The primary reason for that was also communication (reported by 63%, the top reason) but closely followed by more worsened collaboration. Difficult communications were also cited as the main reason for any negative impact on supplier relationships.

On the positive side, design quality was the only business aspect that showed no notable impact from the pandemic—with a vast majority (77%) reporting no impact. Other respondents were encouraged by technology, focus on design, and less distraction.

SUSTAINABILITY DEMAND CONTINUES TO EXPAND

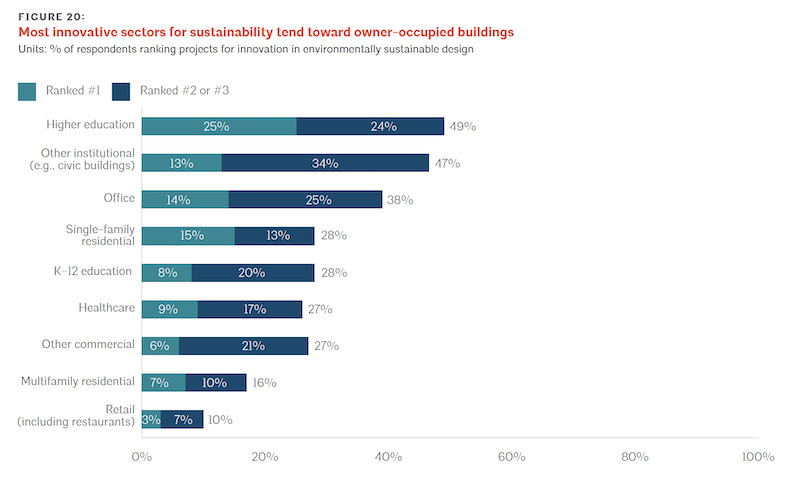

Not surprisingly, Higher Ed is deemed by architects as being the nonres sector where sustainability innovation flourishes. The study found, though, that a sizable number of architects are still on the sidelines when it comes to moving clients toward sustainable project goals.

Architects were hopeful about their opportunities from sustainable design, especially in housing and healthcare projects. The majority of those surveyed reported that clients increasingly are willing to invest in design that leads to better occupant health and productivity (78%) and are willing to pay for design and materials that reduce disease transmission (61%). Additionally, 63% of respondents reported that sustainability concerns increasingly are important when specifying building products/materials and that they are seeing consultants increasingly focused on sustainability.

Across nearly all these measures, significantly higher shares of respondents from the largest firms (500 or more employees, which comprise a substantial share of architectural billings) reported client interest in sustainability.

By way of example, the report quotes a commercial owner in the Southeast who says that sustainability and wellness are “core principles for the group, and climate change is a fundamental consideration. Looking forward, our future projects will have similar sensitivity to the impacts of climate change.”

Even after the pandemic is controlled, data and history suggest that this concern will remain strong, given both owners’ desire to mitigate future risk and the historical strength of improved health outcomes as a driver to green building and sustainable design. Sixty-three percent of respondents also said sustainability is increasingly important in specification of building products and materials.

ARCHITECTS MUST LEAD THE CHARGE TOWARD SUSTAINBILITY

Construction, planning and project management were impacted by the pandemic's restrictions on physical presences on jobsites.

The study revealed a net positive impact of the pandemic on innovation and finding sustainable solutions, with 34% of respondents reporting that the pandemic helped make it less difficult to innovate and 25% noting that it made it less difficult to find new sustainable solutions.

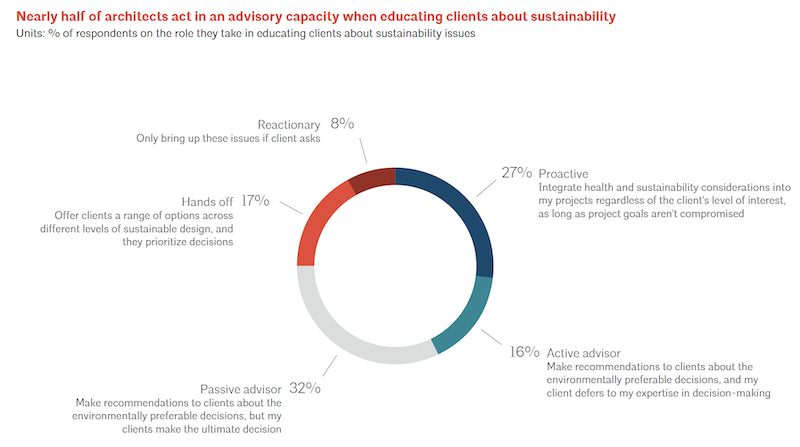

While architects are strong advocates of sustainability, the report states that there room for architects to take on more leadership roles as designers, educators, partners, and specifiers. When it comes to their role educating clients about sustainability, more than a quarter (27%) are on the forefront—integrating health and sustainability considerations into all projects. But nearly half (48%) act in more of an advisory capacity, with that split between those who serve as the decision-maker (16%) and those who defer decisions to clients (32%). And there is still a quarter who are either hands-off, offering options but not prioritizing sustainability, or reactionary.

The report’s findings are consistent with architects’ general approach to new product and material use. While there are a very small percentage of innovators and laggards, most fall into the middle, with 28% of respondents identifying as early adopters and 23% identifying as being in the “early majority,” or using new products after some use.

Related Stories

Construction Costs | Apr 18, 2024

New download: BD+C's April 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

MFPRO+ New Projects | Apr 16, 2024

Marvel-designed Gowanus Green will offer 955 affordable rental units in Brooklyn

The community consists of approximately 955 units of 100% affordable housing, 28,000 sf of neighborhood service retail and community space, a site for a new public school, and a new 1.5-acre public park.

Construction Costs | Apr 16, 2024

How the new prevailing wage calculation will impact construction labor costs

Looking ahead to 2024 and beyond, two pivotal changes in federal construction labor dynamics are likely to exacerbate increasing construction labor costs, according to Gordian's Samuel Giffin.

Healthcare Facilities | Apr 16, 2024

Mexico’s ‘premier private academic health center’ under design

The design and construction contract for what is envisioned to be “the premier private academic health center in Mexico and Latin America” was recently awarded to The Beck Group. The TecSalud Health Sciences Campus will be located at Tec De Monterrey’s flagship healthcare facility, Zambrano Hellion Hospital, in Monterrey, Mexico.

Market Data | Apr 16, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of March 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.2 months in March from 8.1 months in February, according to an ABC member survey conducted March 20 to April 3. The reading is down 0.5 months from March 2023.

Laboratories | Apr 15, 2024

HGA unveils plans to transform an abandoned rock quarry into a new research and innovation campus

In the coastal town of Manchester-by-the-Sea, Mass., an abandoned rock quarry will be transformed into a new research and innovation campus designed by HGA. The campus will reuse and upcycle the granite left onsite. The project for Cell Signaling Technology (CST), a life sciences technology company, will turn an environmentally depleted site into a net-zero laboratory campus, with building electrification and onsite renewables.

Codes and Standards | Apr 12, 2024

ICC eliminates building electrification provisions from 2024 update

The International Code Council stripped out provisions from the 2024 update to the International Energy Conservation Code (IECC) that would have included beefed up circuitry for hooking up electric appliances and car chargers.

Urban Planning | Apr 12, 2024

Popular Denver e-bike voucher program aids carbon reduction goals

Denver’s e-bike voucher program that helps citizens pay for e-bikes, a component of the city’s carbon reduction plan, has proven extremely popular with residents. Earlier this year, Denver’s effort to get residents to swap some motor vehicle trips for bike trips ran out of vouchers in less than 10 minutes after the program opened to online applications.

Laboratories | Apr 12, 2024

Life science construction completions will peak this year, then drop off substantially

There will be a record amount of construction completions in the U.S. life science market in 2024, followed by a dramatic drop in 2025, according to CBRE. In 2024, 21.3 million sf of life science space will be completed in the 13 largest U.S. markets. That’s up from 13.9 million sf last year and 5.6 million sf in 2022.

Multifamily Housing | Apr 12, 2024

Habitat starts leasing Cassidy on Canal, a new luxury rental high-rise in Chicago

New 33-story Class A rental tower, designed by SCB, will offer 343 rental units.