“Ignore the Dow. Focus on the fundamentals.”

That’s Cushman & Wakefield’s sanguine advice in its latest “U.S. Macro Report,” in which the real estate services giant offers a bullish forecast about America’s economy, as well as the investment climate for real estate construction and transactions.

C&W provides a positive spin on investors’ two main concerns right now: the impact of China’s slower economic growth and tumbling global oil prices. The report points out that U.S. direct investment in China is currently $65 billion versus the $6 trillion the U.S. has invested globally. Only 9.2% of U.S. exports are sent to China, and exports account for only around 10% of all goods and services produced within the country. “The macroeconomic consequences of a hard landing in China tend to be overstated,” says C&W, which believes that China’s GDP growth could fall below 3% (it was 6.9% in 2015, a 25-year low) without causing a recession in the U.S.

Oil price erosion is a more significant threat to C&W’s baseline outlook, the report concedes. But it believes that declines in oil prices are ultimately a net positive for the U.S. economy because those declines spur increased consumption. “Every penny decline in retail gasoline prices adds more than $1 billion to consumer spending over the course of the year, according to Moody’s Analytics,” states the report. Its forecast calls for oil prices to average just over $40 per barrel in 2016. “That will add about 50 extra basis points to U.S. GDP growth, creating up to 23.8 million sf in additional demand for office and industrial space.”

C&W foresees a “quite healthy” 2.4% increase in U.S. GDP this year. It expects 2.6 million and 2.3 million nonfarm jobs to be created in 2016 and 2017, bringing the unemployment rate down to around 4.5%. “Wage growth and inflation should trend upwards more meaningfully at the same time, helping to buoy retail sales, consumer spending and consumer confidence.”

People are also getting their personal balance sheets in order. The household debt ratio—which measures debt affordability—is at its lowest point since 1980. Wages and total compensation rose by over 2% in 2015, the first time since 2008 those indices exceeded 2% growth.

A more confident, higher-spending consumer should benefit the industrial sector, which has enjoyed record-setting demand for warehouse and distribution space over the past few years. C&W projects that 220 million sf of space will be added this year, despite declines in manufacturing activity. “Overall vacancy will tighten further, falling from 7.5% in 2015 to 7% in 2016. This is on par with the tightest conditions ever observed in the sector; in 2000, the national vacancy rate was 6.9%,” the report states.

C&W expects that the economy will create 713,000 office-using jobs this year, and 666,000 in 2017. These estimates are slightly down from the 812,000 office jobs created last year, and C&W does expect slower aggregate demand for office space, albeit with a lag. Over the next two years, it expects 140 million sf of new office product to be delivered versus the almost 160 million sf of space that will be absorbed. “As a result, vacancy rates will continue to decline, falling from 14.2% in 2015 to 13% in 2017, the lowest annual reading since 2007.” Rent growth will accelerate to 4% this year and 4.5% next year. By 2018, new development should catch up with decelerating demand.

Positive consumer spending should also help fuel the retail sector. Net absorption is expected to average around its 2015 level (40 million sf) for the next two years, and focus on Class A product or new space. Vacancy is expected to decline from 7.7% in 2015 to 7% in 2016, and bounce below the 7% mark at times during the year.

C&W remains convinced that investors would continue to perceive the U.S. as a “safe haven” for stability and expected returns. Investors certainly showed their confidence in the U.S. economy in 2015, when investment sales volumes in the real estate sector increased by nearly 24% to $534 billion, just shy of the previous peak in 2007. “Capital markets activity is expected to be strong in 2016 and 2017 and should surpass prior peak levels assuming no major shock to the system.”

The developer acknowledges that a prolonged downturn in equity markets could short-circuit the U.S. economy, hit the consumer and end the expansion. But it doesn’t think that scenario is probable. “The fundamentals of the U.S. economy and the property markets remain on solid footing.”

Related Stories

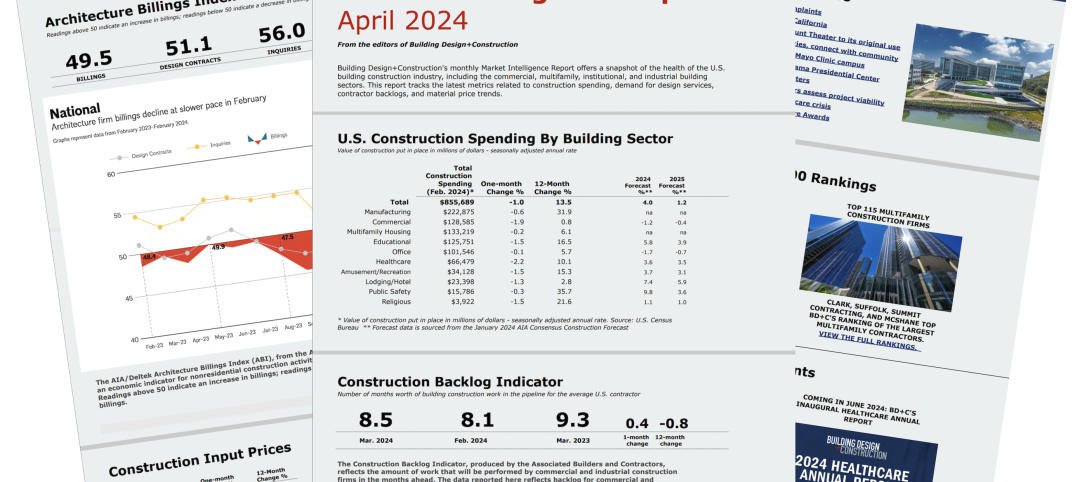

Construction Costs | Apr 18, 2024

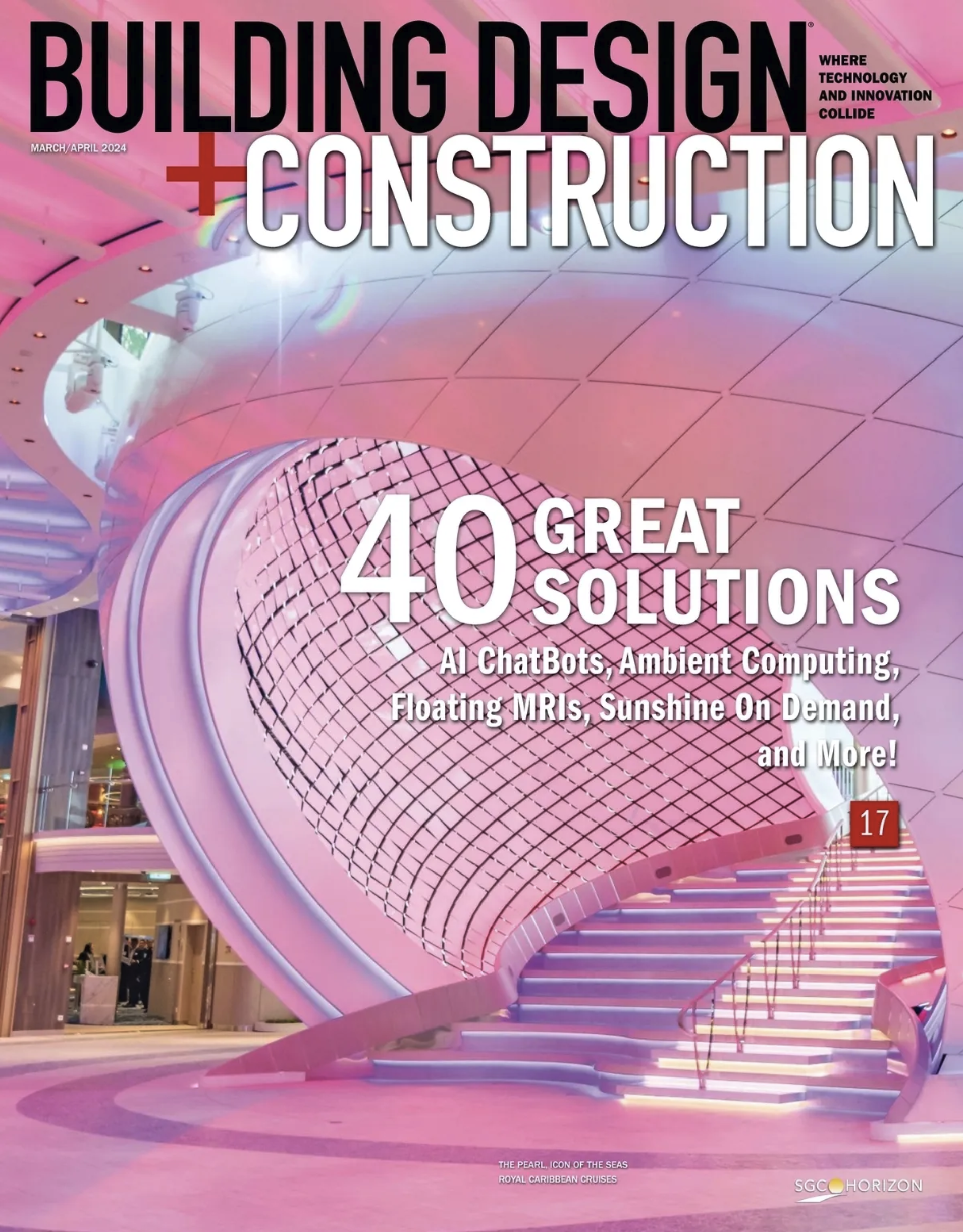

New download: BD+C's April 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Market Data | Apr 16, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of March 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.2 months in March from 8.1 months in February, according to an ABC member survey conducted March 20 to April 3. The reading is down 0.5 months from March 2023.

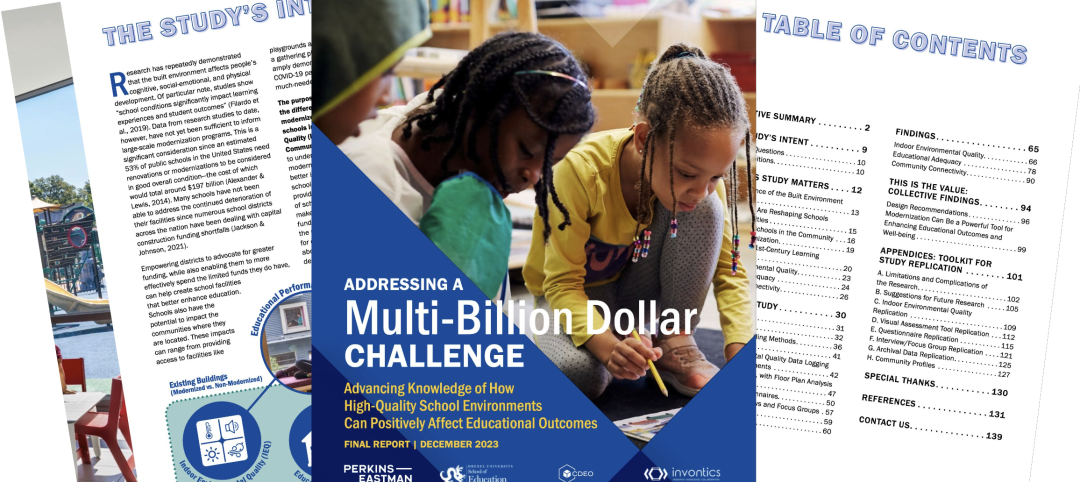

K-12 Schools | Apr 10, 2024

Surprise, surprise: Students excel in modernized K-12 school buildings

Too many of the nation’s school districts are having to make it work with less-than-ideal educational facilities. But at what cost to student performance and staff satisfaction?

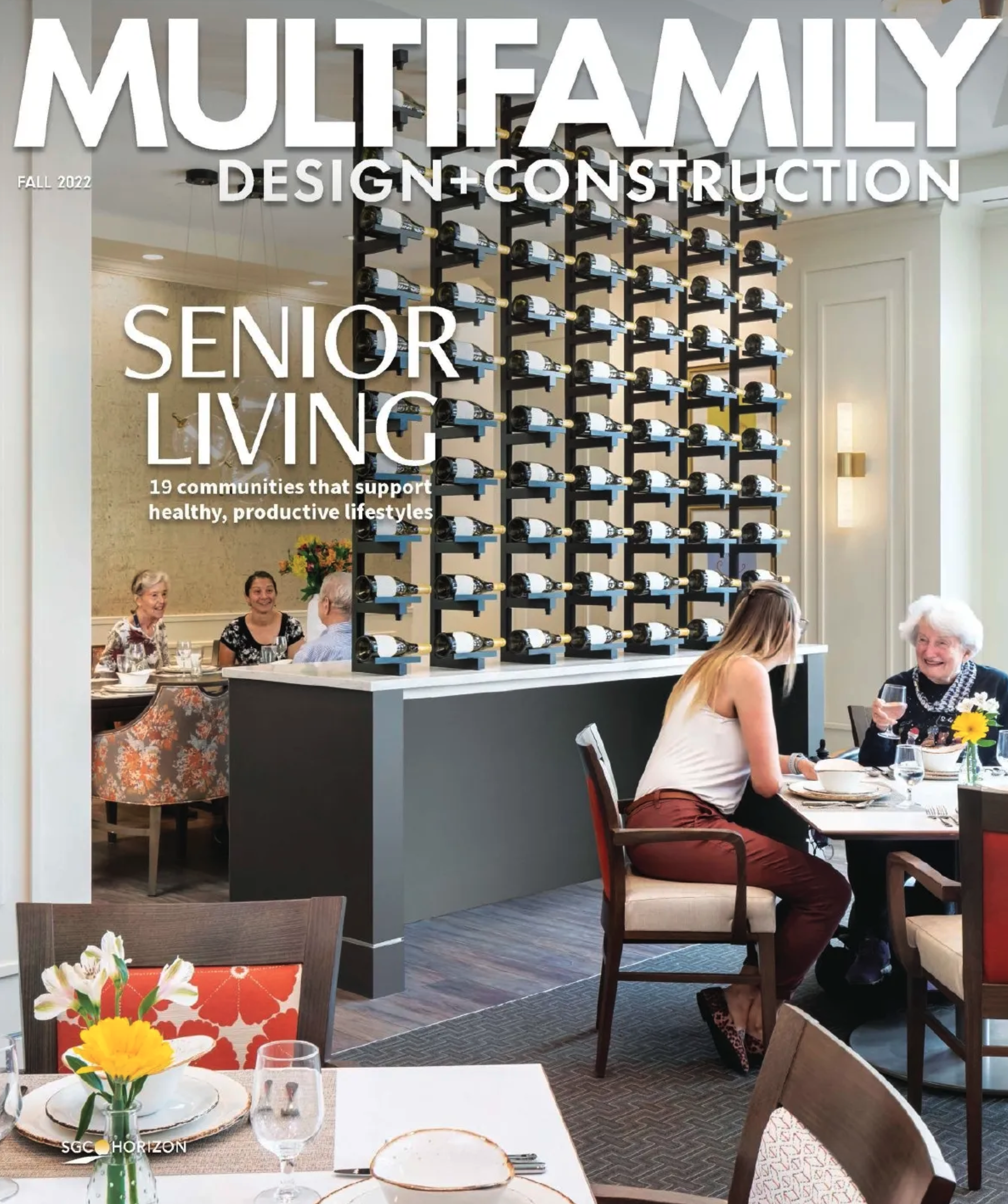

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.

Retail Centers | Apr 4, 2024

Retail design trends: Consumers are looking for wellness in where they shop

Consumers are making lifestyle choices with wellness in mind, which ignites in them a feeling of purpose and a sense of motivation. That’s the conclusion that the architecture and design firm MG2 draws from a survey of 1,182 U.S. adult consumers the firm conducted last December about retail design and what consumers want in healthier shopping experiences.

Market Data | Apr 1, 2024

Nonresidential construction spending dips 1.0% in February, reaches $1.179 trillion

National nonresidential construction spending declined 1.0% in February, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.179 trillion.

Market Data | Mar 26, 2024

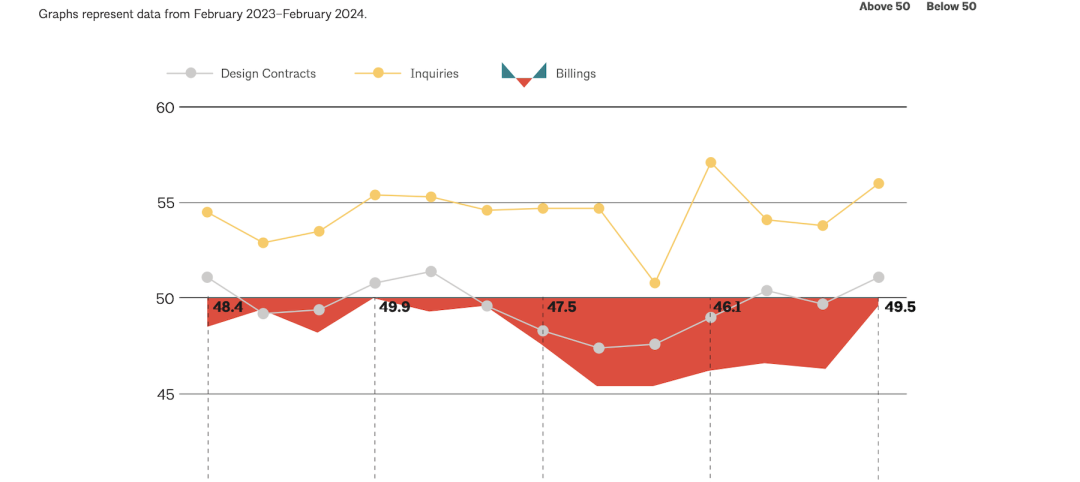

Architecture firm billings see modest easing in February

Architecture firm billings continued to decline in February, with an AIA/Deltek Architecture Billings Index (ABI) score of 49.5 for the month. However, February’s score marks the most modest easing in billings since July 2023 and suggests that the recent slowdown may be receding.

K-12 Schools | Mar 18, 2024

New study shows connections between K-12 school modernizations, improved test scores, graduation rates

Conducted by Drexel University in conjunction with Perkins Eastman, the research study reveals K-12 school modernizations significantly impact key educational indicators, including test scores, graduation rates, and enrollment over time.

MFPRO+ News | Mar 16, 2024

Multifamily rents stable heading into spring 2024

National asking multifamily rents posted their first increase in over seven months in February. The average U.S. asking rent rose $1 to $1,713 in February 2024, up 0.6% year-over-year.

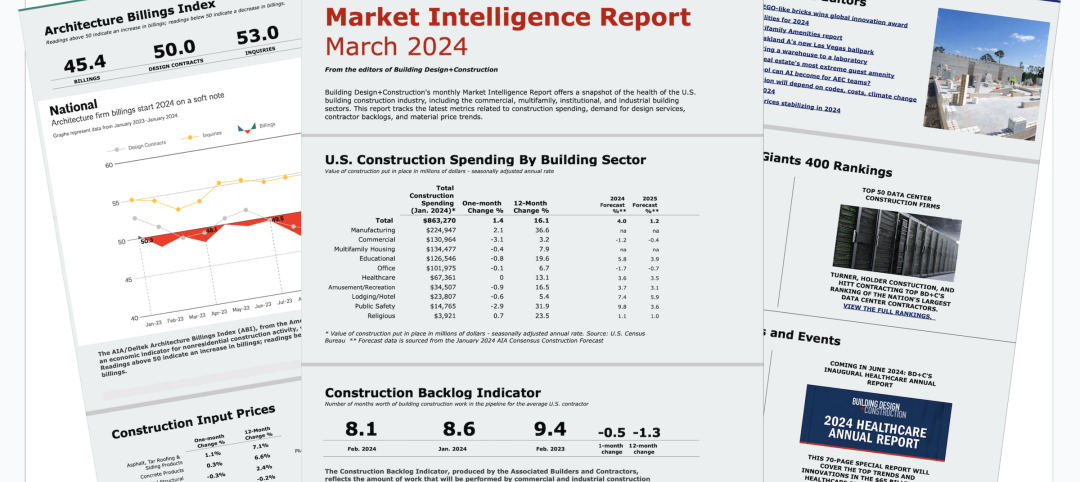

Market Data | Mar 14, 2024

Download BD+C's March 2024 Market Intelligence Report

U.S. construction spending on buildings-related work rose 1.4% in January, but project teams continue to face headwinds related to inflation, interest rates, and supply chain issues, according to Building Design+Construction's March 2024 Market Intelligence Report (free PDF download).