Commercial and residential construction can be as different as night and day. But as one who covered the housing industry for nearly a decade, I firmly believe AEC firms can learn some valuable lessons from the trials and tribulations that home builders experienced during the Great Recession.

The resistance of the housing market to recover at the robust pace that most forecasters predicted only a year ago proves that the roller coaster ride that has been rattling home builders since the mid-2000s isn’t over. In this weird amusement park, growth is contingent on how quickly builders respond and adjust to market forces, and the extent to which they have a clear and realistic perspective on their customers’ motivations and needs.

What, then, can AEC firms learn from the home builders’ experience? Some thoughts:

Cooperation cushions labor shortages. The reverberations from skilled labor’s mass exodus are still being felt throughout the construction industry. During the recession, smart builders positioned themselves as indispensable partners to their trades and subcontractors. One way to do this is to bring them into the planning picture sooner.

One of Colorado’s largest private builders, St. Aubyn Homes, was able to expand during the recession, in part, because it shared its construction plans with its trades and essentially guaranteed their work. The lesson here is that team-building reinforces trust and loyalty, especially during periods of economic instability.

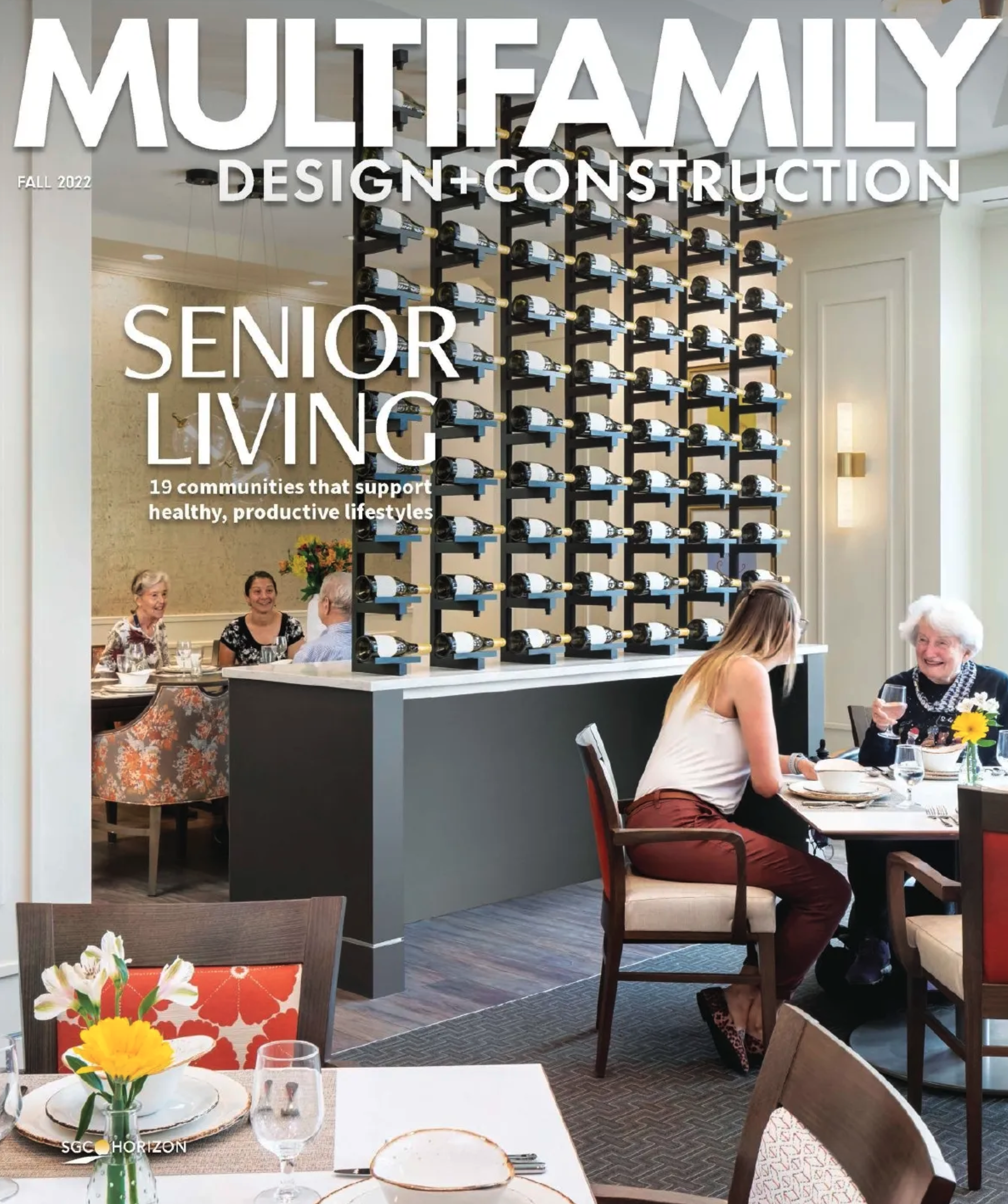

Adversity can be the mother of diversification. When demand for single-family homes evaporated, home builders pushed out of their comfort zones and got into areas like active adult, multifamily, urban infill, and even mixed use. As market conditions improved, most builders kept their ancillary divisions active.

But be careful: Diversification takes patience and expertise. Bringing in new partners or new hires with experience can ease the way into new markets. So can acquisitions, although that’s usually a more expensive route to take. The key for any company that diversifies is to be realistic about the goals and timetables.

Understand what your customers really need. One of the housing industry’s triumphs during the recession was Florida-based Neal Communities, which bucked conventional wisdom by introducing affordable bungalows (some under 1,000 sf) that sold like hotcakes.

Neal saw something its competitors did not, and took a daring chance. Success is often a measure of how deeply Building Teams think through how and why a building will be used, be it a single-family house or a K-12 school.

Technology nudges its way in. Even the most technophobic home builders came out of the recession armed with iPads and smartphones. “Big data” and “analytics” became more than buzzwords. “CIO” and “IT manager” were showing up on their organization charts.

Will this embrace of technology prove to be short-lived, or will it get hard-wired into home builders’ operations and business models? One test will be whether they hire and retain personnel to assess the relative value of new products and programs that inevitably will emerge.

One last thought on this topic: As horrid as the recession was for commercial AEC firms, be glad you weren’t in the home building sector.

More from Author

John Caulfield | Dec 18, 2019

Reconsidering construction robotics

After decades when experts predicted that robots would become more prevalent on construction sites, it would appear that the industry has finally reached that point where necessity, aspiration, and investment are colliding.

John Caulfield | Nov 29, 2015

Leadership or limbo: Moving to building green’s next level

After interviewing more than 50 AEC firms for our Greenbuild Report in the November issue, I wonder if the sustainability movement has hit a wall in the nonresidential construction sector.

John Caulfield | Sep 25, 2014

Look to history warily when gauging where the construction industry may be headed

Precedents and patterns may not tell you all that much about future spending or demand.